<- Back to Main Page

Tags: federal,form

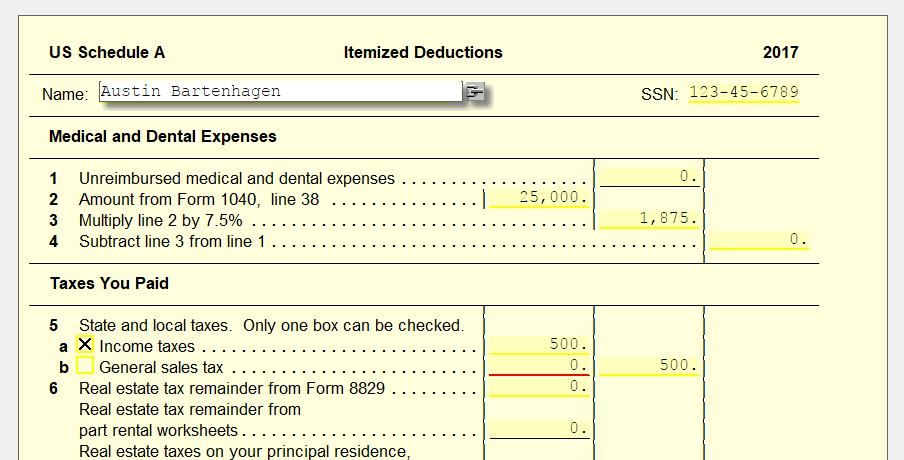

Filling out a Sch. A

If your client is going to be itemizing deductions for the tax year, you’re going to need a Sch A. This can be found in all returns by default.

On the Sch A, you will find Medical and Dental Expenses, Taxes Paid, Interest Paid, and even Job Expenses. While you can list all of these directly on the form, to go into more detail, it’s recommended to use an A Detail Worksheet. This allows you to go more in-depth regarding each expense, especially if there is more than one for a certain category.

Tags: federal,form

Support Center

Support Center