How to use Return Query or EFC Return Lookup

🔍 What is Return Query?

Return Query (also called EFC Return Lookup) is a tool that lets you:

- Check the e-file status of any tax return

- See if a return was accepted or rejected by the IRS

- Find out why a return was rejected and what needs to be fixed

- Check bank product status and refund disbursement info

⚠️ Before You Begin

You will need your Client ID and password to log into the TaxWise Solution Center.

Do not know your login info?

- Go to https://surefiretaxsoftware.com to find your Client ID

- Use the "Forgot Password" feature on the TaxWise login screen

- Check your junk/spam folder for the password reset email

📊 Step-by-Step: How to Look Up a Return

Step 1: Log Into the TaxWise Solution Center

Open your web browser and go to: https://support.taxwise.com

Enter your Client ID, username, and password to log in.

Step 2: Go to Return Query

Once logged in:

- Click on "E-File" in the menu at the top

- Click on "Return Query"

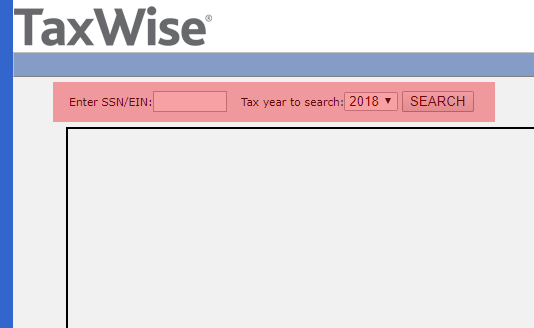

Step 3: Search for the Return

Enter the taxpayer information:

- SSN (Social Security Number) for individual returns, OR

- EIN (Employer Identification Number) for business returns

The Tax Year will default to the current year. Change it if needed, then click Search.

📄 Understanding the Results

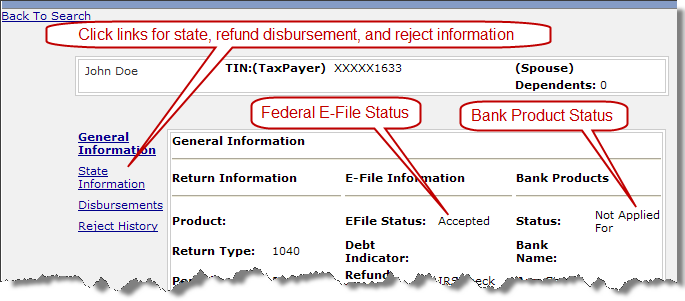

General Information Screen

The first screen shows the General Information for the return, including:

- Federal e-file status (Accepted, Rejected, Pending, etc.)

- Bank product status

- State e-file status (click the State links for details)

- Refund disbursement information

❌ How to Find Why a Return Was Rejected

If a return was rejected, follow these steps to find out why and what needs to be fixed.

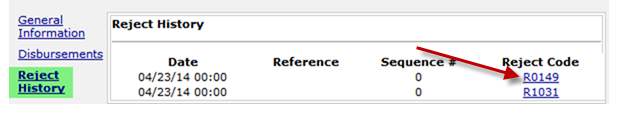

Step 1: Click "Reject History"

On the return details page, click the "Reject History" link to see all rejects for this return.

Step 2: View the Most Recent Reject

Double-click on the most recent reject in the list to see the details.

Step 3: Click the Reject Code

Click on the Reject Code link to see:

- The explanation of what caused the reject

- The actual value in the return that is causing the problem

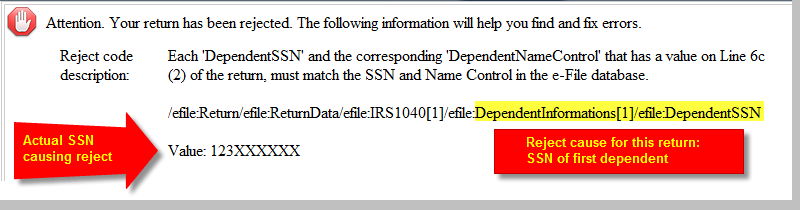

💡 Example: Understanding a Reject

In the example below, the reject is caused by the SSN of the first dependent. The SSN entered in the return does not match what the IRS has on file.

To fix this: Verify the dependent SSN with their Social Security card and correct it in the return.

📝 Common Reject Reasons

- SSN/Name mismatch - Name or SSN does not match IRS records

- Dependent already claimed - Someone else already claimed this dependent

- Prior year AGI incorrect - The AGI entered for identity verification is wrong

- IP PIN required - Taxpayer has an Identity Protection PIN that was not entered

- Duplicate filing - A return with this SSN was already accepted

📞 Still Need Help?

If you need help understanding a reject code or fixing a return, contact our support team:

Phone: 1-800-516-9442

Tags: web,install,setup

Support Center

Support Center